Sam Bankman-Fried's risky business

Two recent books by Nate Silver (On the Edge: The Art of Risking Everything) and Michael Lewis (Going Infinite: The Rise and Fall of a New Tycoon) shed light on a sociopathic crypto titan.

Tom Brady and Giselle Bundchen called him “revolutionary.” Larry David appeared in a Super Bowl Ad for his company, FTX. Katy Perry joked about “quitting music and becoming an intern for [FTX].” Former President Bill Clinton and former U.K. Prime Minister Tony Blair both sang his praises at a conference he co-hosted in the Bahamas.

In 2022, Sam Bankman-Fried (SBF) was named #41 on the Forbes’ 400 Wealthiest Americans with an estimated net worth of $22.5 billion. Within the span of one week in November of that same year, his net worth dropped to $0.

He once paid $155 million for naming rights of the Miami Heat’s stadium. Now, SBF is serving a 25-year sentence after being convicted of seven criminal charges, including wire fraud, commodities fraud, securities fraud, money laundering, and campaign finance law violations.

How he got to that point is the topic of Michael Lewis’ “Going Infinite: The Rise and Fall of a New Tycoon.” It is also the dominant storyline in the second half of Nate Silvers’ “On the Edge: The Art of Risking Everything.” Both authors had the fortune of interviewing SBF before, during and after his downfall, which makes for a fascinating read.

The SBF Mystique

In the opening chapter of Lewis’ book, he shares an anecdote about watching none other than Anna Wintour practically beg SBF to be the co-chair of the Met Gala. The conversation took place via Zoom. SBF absentmindedly played a video game on another screen while occasionally interjecting “yep” so it wasn’t completely obvious he was only paying half attention. He didn’t know who she was other than an editor of a magazine.

Can you imagine this woman putting up with that?

SBF wasn’t always hounded by celebrities and public figures. He grew up lonely and isolated, partly due to his emotionally distant parents and partly due to his inability to connect with other people.

When he entered the world of finance after graduating from MIT, he realized this inability to appear interested in people was a stumbling block to getting what he wanted. So he got better at faking it. According to Lewis:

[SBF] long since realized that his inability to convey emotion created a distance between himself and others. Just because he didn’t feel the emotion didn’t mean he couldn’t convey it. He’d started with facial expressions. He practiced forcing his mouth and eyes to move in ways they didn’t naturally.

This total detachment from SBF was not uncommon. He would play video games during interviews with major networks. People seemed to view this bizarre behavior as part of his quirkiness, his mystique. You couldn’t really read SBF and SBF had difficulty reading other people. So people filled in the gaps with the most positive interpretations.

This indecipherable personality served SBF well in the cryptocurrency industry, which, from my perspective, is driven by vibes. At least more so than say, government-issued bonds.

Indecipherable is also how I would describe the world of cryptocurrency, especially the business of FTX. I asked ChatGPT to explain the business model of FTX (or at least what the public and shareholders were led to believe) and got this:1

FTX was a cryptocurrency exchange where people could buy, sell, and trade various digital currencies like Bitcoin and Ethereum. Think of it like a stock market but for cryptocurrencies. FTX made money in a few main ways: it charged fees every time someone made a trade, and it also offered special features like advanced trading tools for more experienced users, which could also come with extra costs. Additionally, FTX created and traded its own digital tokens and provided loans and other financial services to its users. The idea was to attract lots of traders by offering a wide range of services and making it easy to trade, and then profit from all the activity and fees generated.

That seems like a much better explanation than I could come up with, because my general understanding of crypto is this (warning: language at the end):

Ineffective Self-interest

A driving force in much of the hype and business practices of FTX was effective altruism, a branch of utilitarianism that aims to “figure out, of all the different uses of our resources, which uses will do the most good, impartially considered.“2 The rightness or wrongness of an act is dependent on its impact. This is in contrast with deontological moral reasoning, which states that the rightness or wrongness of an act is inherent in the act.

To grossly oversimplify, if you asked a utilitarian if it is morally right to kill one person to save five, they would answer yes because five lives is more than one life. If you were to ask a deontologist the same question, they would respond no because killing one person—regardless if it leads to saving others—is morally wrong.

SBF initially became interested in EA after hearing a lecture from Will MacAskill, an Oxford professor and leading figure in the EA movement. The topic was “earning to give,” or as Silver puts it, “basically making as much money as you can, and then donating a substantial fraction of it to charity.” Since EA is focused on theoretical impacts, you can really justify any kind of capitalistic endeavor.

It’s this kind of thinking that rationalizes spending hundreds of millions in marketing on everything from three-year deals with Coachella, Steph Curry, Mercedes’ Forumula 1 team; a five-year deal with Major League Baseball; and a seven-year deal with the video game developer Riot Games. They even paid Shark Tank’s Kevin O’Leary $15.7 million for “twenty service hours, twenty social posts, one virtual lunch and 50 autographs.” It’s for the greater good! The more exposure FTX got, the more money it would make, and the more money FTX made, the more good in the world it could do. We’re securing the naming rights of basketball stadiums for the sake of future generations!

At one point, the FTX Foundation claimed it might donate up to $1 billion per year to EA-related causes (that did not ultimately happen).

Among the many pitfalls of effective altruism is that it results in “the ends justify the means” thinking. And if you have convinced yourself your ends involve saving humanity, you can start to justify some very questionable means.

Where did all the money go?

That FTX was a house of cards seems glaringly obvious in hindsight. FTX and Alameda Research were blowing through money at a rapid pace with little to no oversight.

During this time, FTX did not have a chief financial officer. Let me state that again: a financial exchange company with roughly $15 billion in crypto assets and investments, and tens of millions of dollars in daily exchanges did not have a CFO or anything coming close.

There was also no org chart—SBF didn’t believe in titles. In a company of roughly 300 people, there was mass confusion about who reported to whom and who played what role. The only person with any real sense of how the organization worked was the corporate psychiatrist—or “Senior Professional Coach”—who had a steady stream of people come to his office to complain about the dysfunction.

FTX technically had a board, but they were so uninvolved in any decisions SBF couldn’t recall their names when Lewis inquired about them. According to SBF, “The main job requirement is they don’t mind DocuSigning at three a.m. DocuSigning is the main job.”3

While SBF often made massive business and financial decisions on a whim with little input, he had no interest in other major decisions—like how the company’s headquarters should look and function. After FTX moved it’s headquarters to the Bahamas, two architects were tasked with designing a mini-city comprising the office, amenities and living quarters for FTX employees. The architects were given zero input from SBF who wouldn’t answer basic questions such as how many employees will be housed here?

When the architects finally saw SBF in person for the first time—at the announcement ceremony for the new compound—they asked him, “What’s one thing you want out of these buildings, other than work?” SBF gave one answer: badminton courts.

The FTX Foundation, the company's philanthropic arm, was throwing money at groups without due diligence or strategy. As Lewis put it:

Over the previous six months, one hundred people with deep knowledge of pandemic prevention and artificial intelligence had recieved an email that said, in effect: Hey, you don’t know us, but here’s a million dollars, no strings attached. Your job is to give it away as effectively as you can.

And yet the money kept coming. Until it didn’t. In November 2022, journalists began to do some digging and raised questions about this obvious house of cards. Investors and customers began withdrawing their funds en masse, creating a sort of bank-run (crypto exchanges are not FDIC insured) and within the span of 10 days FTX went from one of the largest and most successful crypto exchanges to filing for bankruptcy, with $8 billion unaccounted for. (Here is a good bullet-point rundown of the timeline.)

When Silver met with SBF months after the full collapse of FTX, Silver was alarmed that SBF appeared to show no signs of remorse: “nearly everything SBF said just made me question whether he had any values at all—or judgment.”

Recent Posts

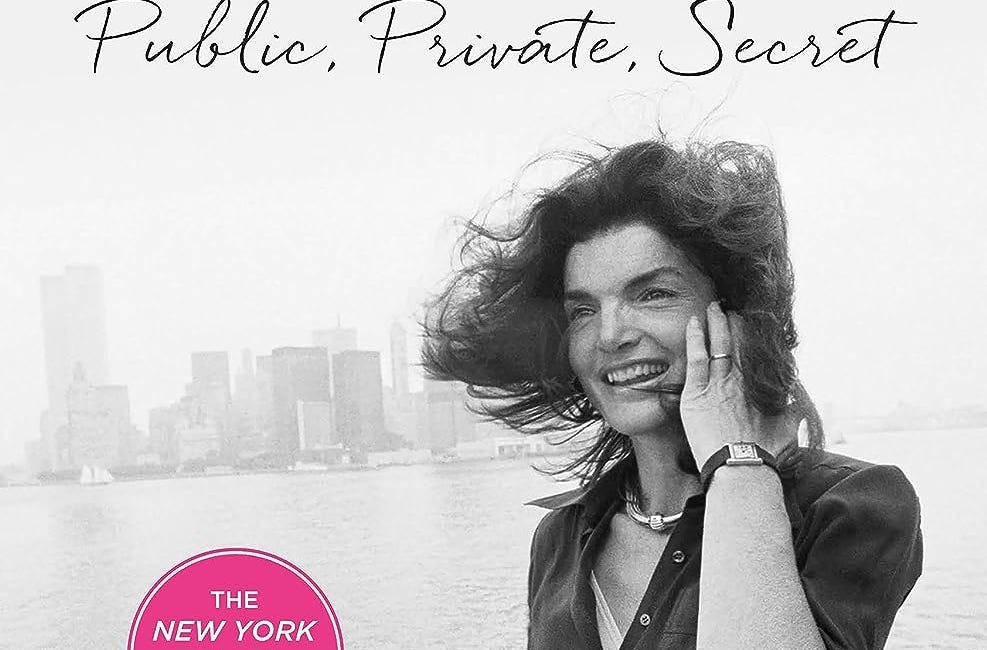

Like her husbands, Jackie Kennedy Onassis was appalling

Joseph P. Kennedy Sr. offered Jackie Kennedy $100,000—the equivalent of $1 million today—for a first child she would carry “to term.” The phrase “to term” being key because Jackie had suffered multiple miscarriages. Joseph Kennedy wasn’t going to cut a check for a stillbirth.

"All the memories, the emotions were all still there on some level. That was surprising to me."

When Rob Henderson offered his followers a chance to talk with him, I eagerly signed up. I thoroughly enjoyed his memoir, “Troubled: A Memoir of Foster Care, Family and Social Class” and his many appearances on some of my favorite podcasts, including

The prompt was: “Please provide one paragraph describing the business model of FTX, the cryptocurrency exchange created by Sam Bankman-fried. Explain it in ways a high schooler would understand, with limited technical jargon.”

Will MacAskill, “The Definition of Effective Altruism,” provided in Nate Silver’s “On the Edge.”

You might have detected a pattern here: SBF essentially called all the shots with no accountability or oversight or need to confer with anyone but himself.